Discover

"Our advisory process provides tailored experiences and effective solutions to each of our clients." - Jeremy Mitchell, CFP®

Managing Your Wealth

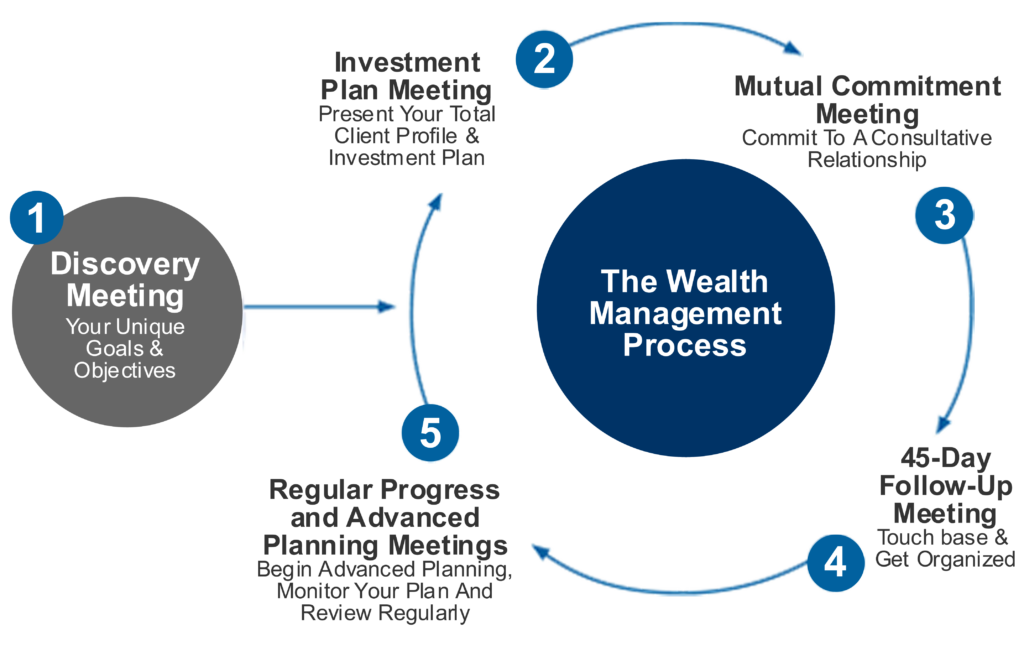

The heart of our business is the consultative partnership -- the advisory relationship which we enter into with our clients. Whatever your financial situation, The Robert Harding Financial Group will respond with reliable and personal advice designed to suit your requirements. Your consultant will invest time to get to know you and your preferences, and will offer sound and trustworthy financial advice that evolves to fit your needs as they change over time. The following guide illustrates how your relationship begins with our firm:

The Consultative Wealth Management Process

Our Investment Approach

We urge our clients to take uncertainty in stride and to focus on controlling what they can: risk exposure and return expectations. While the future remains uncertain, we construct portfolios to help mitigate uncertainty by employing prudent diversification among asset classes, risk factors, and return drivers--all while implementing investment strategy and security selection based on certainties such as an investor’s goals, attitudes, and risk preferences. We help investors understand their need for income, growth, and liquidity from their investments and work with them to construct a prudently diversified portfolio that takes advantage of what we do know, while protecting against what we don’t.

Building a Portfolio

Hypothetical Portfolio Composition

By combining our current economic outlook and our macro-market expectations, a basic portfolio allocation is devised utilizing major asset classes. Macro-market assumptions often determine not only broad asset allocation, but the focus and type of strategy implemented, whether it be an index strategy, managed strategy, or tactical/hedge strategy. Finally, specific vehicles and managers are selected to implement your tailored investment portfolio.

For Clients

Our Business

The Robert Harding Financial Group specializes in delivering face-to-face, consultative wealth management advice to individuals, trustees, and businesses.

In addition to addressing simple issues such as mortgages and insurance, we can help to resolve more complex problems for clients, like investing for growth or estate tax and retirement planning.

In general, we provide reliable and expert guidance to those seeking to achieve one or more of five principal financial objectives:

- Investment Consulting - Build and preserve your capital.

- Wealth Enhancement - Manage your cash flow and borrowings, minimize the negative impact that taxes can have on your wealth.

- Wealth Protection - Protect yourself against financial risk, keep your assets from being unjustly taken from you.

- Wealth Transfer - Plan to efficiently transfer and to maximize wealth to the next generation, or to persons of your choosing.

- Charitable Giving - Create gifting plans to effectively and efficiently help charitable causes that you care about most.

Finally, we function as your personal CFO, coordinating a hand-selected team of experts to develop the most effective plan to help you achieve your goals.

RHFG helps coordinate and facilitate the fulfillment of your goals.

The Partnership

The heart of our business is the consultative partnership -- the advisory relationship which we enter into with our clients. Whatever your financial situation, The Robert Harding Financial Group will respond with reliable and personal advice designed to suit your requirements.

We believe that our success is a result of two fundamental principles that have underpinned our business since it began in 1995: the strength of our relationship with our clients, and our distinctive approach to wealth management.

Your Team

Larry R. Mitchell

Branch Manager / Registered Principal

Senior Vice President

Summary: Helping clients successfully plan for their financial future since 1983, Larry has a proven record of accomplishment, and exceptional experience. Larry provides an unmatched level of financial services. He began his career with Dean Witter Reynolds, now Morgan Stanley. Larry formed the Robert Harding Financial Group in 1994.

Education: Bachelor of Science, Business Administration (Harding University, 1974). Registered Representative (FINRA Series 7, 63, 1984 - Registered in various States). Registered Principal (FINRA Series 24, 1994). Municipal Fund Securites Limited Principal (FINRA Series 51, 2003). Life, Health, Disability Insurance (State of Arizona, various other States).

Check the background of this investment professional on FINRA’s BrokerCheck.

Jeremy S. Mitchell, CFP®

Wealth Manager

Summary: Jeremy Mitchell helps individuals and families align their wealth decisions with their highest values.

Mr. Mitchell is a Wealth Manager and CERTIFIED FINANCIAL PLANNER™ practitioner with The Robert Harding Company, which is dedicated to helping a select group of affluent clients manage their wealth to achieve all that is important to them. He specializes in working with business owners as well as with affluent individuals and families using a consultative, 5-step wealth management process.

Successful individuals and families engage The Robert Harding Company to:

- Define their highest values for their money.

- Work consultatively to develop an investment plan to help achieve their financial goals.

- Work collaboratively with their other advisers (CPAs, Attorneys, etc) to create advanced planning priorities that directly express the client’s highest values for their wealth, and to implement those advanced planning priorities in areas of emphasis such as Wealth Enhancement, Wealth Protection, Wealth Transfer, and Charitable Giving.

Mr. Mitchell has served clients of the firm since 2004. He received the CERTIFIED FINANCIAL PLANNER™ designation in 2007. He works with his father, Larry Mitchell, who has served affluent clients in over 20 states since 1983.

Education: Bachelor of Business Administration, Computer Information Systems (Summa Cum Laude, Harding Unversity, 2003). Registered Representative (FINRA Series 7, 2004). General Securities Sales Supervisor (FINRA Series 9/10, 2004). Life, Health, Disability Insurance (State of Arizona, 2004). CERTIFIED FINANCIAL PLANNERtm certificant (CFP® Board of Standards, 2007).

Check the background of this investment professional on FINRA’s BrokerCheck.

News and Articles

A New Collaboration Tool for Clients and Professional Partners

Clients and professional partners have enjoyed using our tools that permit secure transmission of personal data. We will be migrating non-email applications of this functionality to Box.com going forward. (Please note we will still utilize NeoCertified for secure transmission of sensitive information via email.) Sending us files in an encrypted …Read More »Lincoln Extends Annuity Contract Maturity Dates

Key Takeaways: Lincoln Life has extended the maturity dates on their annuity contracts to age 99. No action is required on the part of annuity owners or annuitants. Many of you have begun receiving notices that Lincoln Life has extended the maturity dates on your Lincoln annuity contract(s). Insurance companies …Read More »2015 Tax Information Update

Clients and Friends, It is tax season once again and we have aggregated some information to help you and your tax professional better navigate through the documentation and deadlines for tax reporting from our various partner investment firms. For those of you with Geneos Retail, Advisory, and SelectOne Advisory accounts …Read More »

Contact Us

OUR OFFICE

Address

Suite D149

Glendale, Arizona 85308

Contact

| Phone | 623-977-9823 |

| Toll-Free | 800-977-9823 |

| Facsimile | 623-977-0181 |